Profit growth in 2025

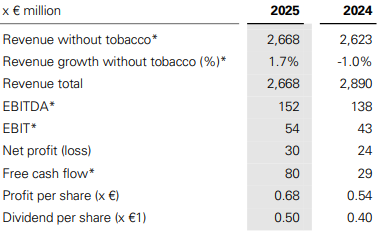

Modest recovery in our sales markets and cost control are leading to improvement in our profitability. The operating result (EBIT) increased by €11 million to €54 million and net profit rose by €6 million to €30 million. A strong balance sheet and good cash flow provide scope for dividend and share buyback.

CEO Koen Slippens: “Our sales markets showed a modest recovery this year. In the Netherlands, there was not only inflation but also some volume growth. The Belgian market also saw growth, but this remained purely inflation-driven. Cost inflation subsided, although we still faced some considerable price rises in logistics in particular. The cost-cutting measures we have taken in recent times enabled us to absorb these impacts comfortably and there was some scope to pass on these higher costs along the value chain.

The combination of profitability and improved working capital led to a strong cash flow. We were therefore able to make the planned capital investments in our digital ambitions and physical network, acquire GEPU, pay a dividend and further reduce our debt. Based on that result and our dividend policy, we propose a dividend for 2025 of €0.50 per share. As an interim dividend of €0.40 per share was already paid in 2025, a final dividend of €0.10 per share remains."

Key figures

* This is an alternative performance measure; see the appendix of the press release for further details.

Announcement of share buyback programme

We announce the introduction of a share buyback programme of up to €26 million, which will operate between 6 February 2026 and 14 November 2026 in addition to payment of the regular dividend. Shares repurchased under the programme will be cancelled.

We have appointed an independent financial intermediary to carry out the programme, with the authority to purchase up to 2,212,750 shares, equal to 5% of the Group’s issued share capital. The exact timing of the purchases will be determined independently by the financial intermediary, without any input from Sligro Food Group.

The programme will be run in accordance with the requirements of Article 5 of the Market Abuse Regulation (EU) No. 596/2014 and our articles of association. Operation of the programme is dependent on market conditions and may be suspended, changed or terminated at any time.

We will publish the progress of the programme weekly through press releases on this website

Download the complete press release:

Press conference / Analyst meeting

Comments on the annual figures at a press conference and an analyst meeting on 5 February 2026.

11:00 AM: Press conference

01:30 PM: Analyst meeting

Location: Sligro, Van der Madeweg 39, 1114 AM Amsterdam

Other important dates

Capital Markets Day: 5 March 2026

Trading update for Q1 2026: 16 April 2026

2026 half-year figures: 23 July 2026

Would you like to receive press releases of Sligro Food Group in your mailbox? Please sent an e-mail with your name, address and e-mail to Vivienne de Jong: vdjong@sligro.nl