2024 half-year figures

Revenue in sales markets under pressure, plans on track

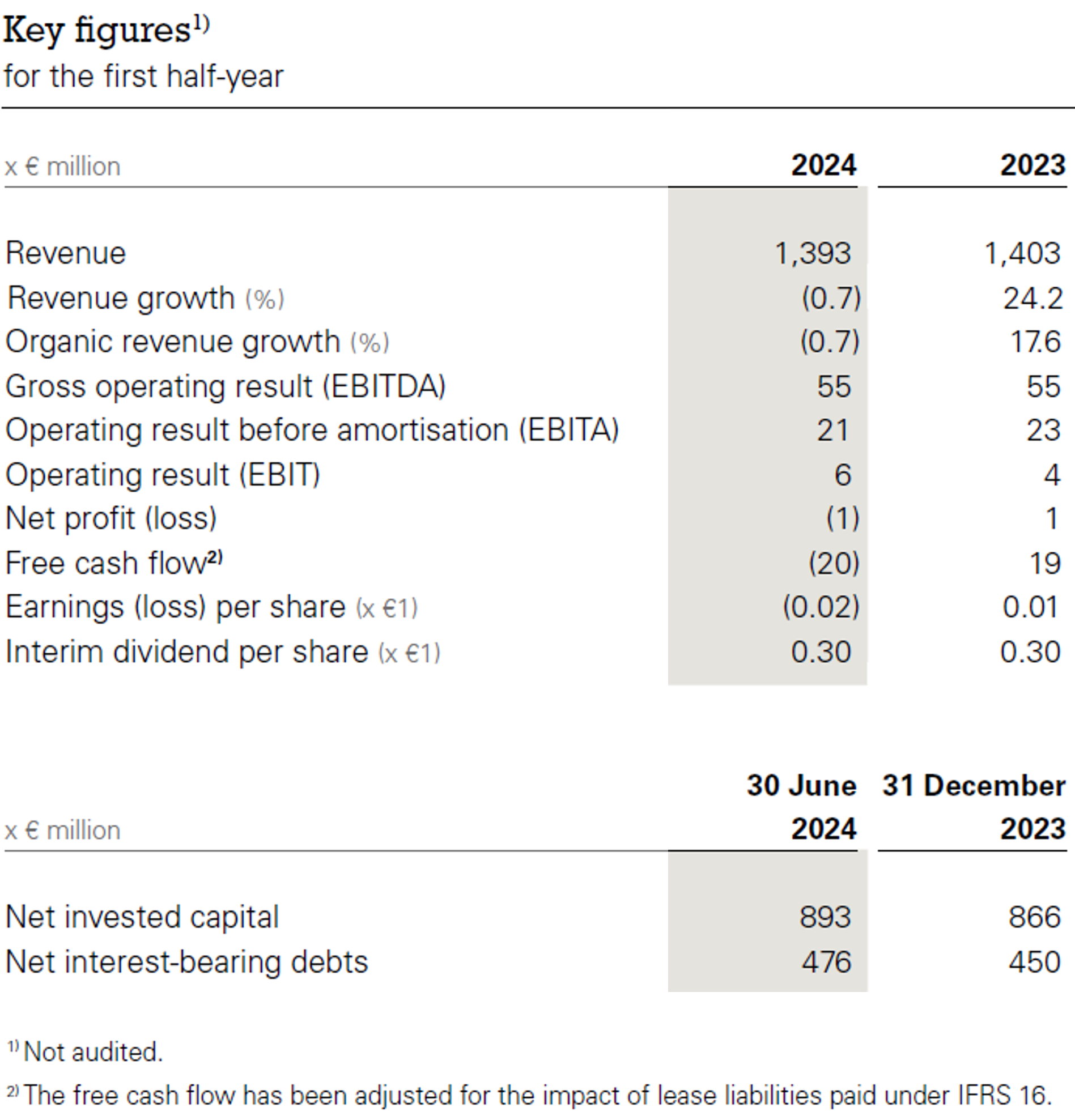

18 July 2024 - Group revenue for the first half of 2024 totalled €1,393 million, down 0.7% on the same

period in 2023. Despite that, our EBITDA was at the same level as last year at €55 million and our operating result grew by €2 million to €6 million. Net profit fell to a loss of €1 million due to rising interest expenses.

Koen Slippens, CEO: “As expected, market conditions are challenging both in the Netherlands and in Belgium. Consumer confidence remains low and the impact of the high level of inflation we have seen in recent years and the poor weather is holding back consumer spending. Even though shifting tobacco sales between different retail sales channels muddies the picture somewhat, the underlying trend is clearly visible.

Away from the developments in the market, we have made a few choices in our organisation that will not contribute to revenue growth in the short term. We have switched our whole Belgian infrastructure to our existing IT environment over the past nine months and are still physically refurbishing several of our sites. Given that both these interventions will help us better serve our customers, we are seeing scope for revenue recovery and growth in Belgium from the second half of the year onwards. In the short term, however, our customers will be inconvenienced.

In addition, we have decided in close consultation with a number of customers to discontinue services whenever there were no prospects for a profitable arrangement for both parties. Both elements are part of our plan to improve returns in the long term, but will result in a revenue drop in the short term.

Since we have only limited influence on market conditions and economic sentiment, our focus within the organisation is mainly on things we can influence directly. On the one hand, this translates to resolute implementation of our plan intended to improve returns, while on the other hand we are putting even greater effort into reducing costs to be able to absorb the impact of rising prices and dropping volumes. We are on track for most elements of our plan, with the exception of the revenue-related initiatives. With these efforts, we are laying the foundation for improvement of our returns, which we believe will pick up momentum as soon as the market starts to recover. Additional cost-saving measures have been identified and are being implemented. In addition, we will be putting a lot of our efforts into customer retention and acquisition in this competitive market, so as to give revenue development a boost.

We had anticipated the difficult market conditions and knew that we were about to put a plan in motion that was going to see us incur costs first and reap benefits later. Knowing that, the figures we are presenting today did not come as a surprise to us. Even so, market developments and inflation are having a greater impact than we had estimated. We are, therefore, still somewhat cautious in our outlook for the second half of the year. We do not expect the market to recover this calendar year and are heading for an operating result (EBIDTA) that is on a par with last year’s.”

Click here for the complete press release (pdf)

Click here for the complete press release (pdf)

In our trading update of 17 October 2024, we will go into revenue developments in the third quarter of 2024 in greater detail.

Would you like to receive press releases of Sligro Food Group by e-mail?

Please sent an e-mail with your name, address and e-mail to Charissa Kleij: ckleij@sligro.nl