Sligro Food Group acquires GEPU

Veghel, 4 June 2025 - Sligro Food Group N.V., with its registered office in Veghel, and GEPU, which has its registered office in Utrecht, announce that they have reached agreement on Sligro Food Group Nederland B.V. acquiring the shares in GEPU Beheer B.V.

GEPU is a delivery service and cash-and-carry wholesaler located in Utrecht that targets hospitality businesses and high-volume consumers in the city of Utrecht and a 30-kilometre radius around the city. A family-run business with a well-established name and 50 years’ experience in the region, GEPU offers a comprehensive range of food and non-food products in store or to order online with delivery or in-store pickup. They are particularly strong in products from countries around the Mediterranean.

GEPU expects to generate around €15 million in revenue for 2025. The company employs 40 permanent staff (35 FTEs). For the short term, GEPU’s operations will be continued in the manner to which GEPU’s customers have become accustomed. Later this calendar year, GEPU’s delivery operation will be transferred to Sligro’s delivery service site in Vianen. After the integration phase, GEPU’s customers will be able to use Sligro’s network of outlets in Utrecht, Nieuwegein and elsewhere in the region for all their cash and carry needs.

Download the full press release:

On behalf of Sligro Food Group N.V.

Koen Slippens, CEO

Rob van der Sluijs, CFO

Would you like to receive press releases of Sligro Food Group in your mailbox?

Please sent an e-mail with your name, address and e-mail to Vivienne de Jong, vdjong@sligro.nl

Trading update first quarter 2025

Veghel, 17 April 2025 - Sligro Food Group N.V. generated €574 million in revenue in the first quarter of 2025, a decline of €78 million on the revenue of €652 million posted in the first quarter of 2024. Corrected for the shift of Easter, the effect of leap day and the cessation of tobacco sales in the Netherlands, the Group’s revenue rose slightly. We look forward to the second quarter with confidence.

Traditionally, year-on-year revenue development over the first two quarters of the year has always been difficult to track due to the timing of the Easter holidays. In 2024, not only was Easter early, the first quarter also had one additional revenue day due to it being a leap year. The leap day produced a one-off benefit in revenue in 2024 and the Easter revenues will shift to the second quarter in 2025. In the Netherlands, we have stopped selling tobacco completely as of 1 January 2025. In Belgium, we didn’t sell tobacco. The impact of these special circumstances are reflected in the table above.

Download the full press release:

We refrain from making concrete predictions about the half-year results. The half-year figures will be published on 17 July.

On behalf of Sligro Food Group N.V.

Koen Slippens, CEO

Rob van der Sluijs, CFO

Would you like to receive press releases of Sligro Food Group in your mailbox?

Please sent an e-mail with your name, address and e-mail to Vivienne de Jong, vdjong@sligro.nl

Trading update first quarter 2024

Veghel, 18 April 2024 - Sligro Food Group N.V. generated €652 million in revenue over the first quarter of 2024, up €18 million or 2.7% on the revenue of €634 million posted in the first quarter of 2023.

As expected, revenue growth was slightly positive over the first three months of the year and was fully organic.

In the Netherlands, revenue was up 3.8% in line with the general upward trend we are seeing in the market. Both the new customer growth rate and expansion of packages for existing customers are developing well. However, consumers are still cautious in their spending, which is leading to our professional customers individually buying less volume right now.

In Belgium, revenue fell by 3.2%. As expected, the customer churn we saw at our delivery site in Antwerp last year continued to have an impact on revenue development over the first quarter of 2024. New customer acquisition is progressing well and we have even started to see some of the customers we lost last year return. At Sligro-M’s cash-and-carry outlets, revenue grew to €37 million compared to €31 million in the same period last year.

The impact of inflation on our revenue levelled off in the first quarter and is now around the 3% mark.

With more and more retailers opting to stop selling tobacco well before the ban comes into effect, we are seeing tobacco sales shift to the outlets of some of our customers. On the back of this development, tobacco’s share in our revenue grew to 9.2% in the first quarter. Sligro will stop selling tobacco from 1 July 2024, with the exception of tobacco sales under several contracts that run to the end of 2024. We will stop selling tobacco altogether from 2025.

Over the coming period, we will maintain an unwavering focus on putting into place the building blocks for our plan in the run-up to 2025, which we presented during our capital markets day last year.

We refrain from making concrete predictions about the half-year results. The half-year figures will be published on 18 July.

On behalf of Sligro Food Group N.V.

Koen Slippens, CEO

Rob van der Sluijs, CFO

Click here for the press release in PDF

Would you like to receive press releases of Sligro Food Group in your mailbox?

Please sent an e-mail with your name, address and e-mail to:

Charissa Kleij: ckleij@sligro.nl

Trading update first quarter 2023

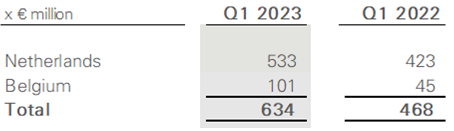

Veghel, 20 April 2023 - Sligro Food Group N.V. generated €634 million in revenue over the first quarter of 2023, up €166 million or 35.5% on the revenue of €468 million posted in the first quarter of 2022.

The revenue increase in the first quarter was positive, as expected. In the first few weeks of 2022, lockdowns were still in place, which ended over the course of that quarter. In increasing our revenue, we have exceeded the market in both countries and further reinforced our position.

Revenue growth in the Netherlands was entirely organic. In Belgium, the revenue came from the outlets acquired from Metro, which generated €31 million in revenue in the first quarter. We are delighted about and proud of the way we reopened the outlets following the acquisition. The revenue levels posted in the first quarter are encouraging.

We refrain from making concrete predictions about the half-year results. Instead, we focus our attention once again on several exceptional elements that are important or have the greatest impact in the first half-year in particular. In 2022, we posted a one-off book profit on the Smeding transaction. In 2023, we are facing additional SAP amortisation charges and start-up losses for the outlets acquired from Metro. The finance costs are increasing, due to general interest rate developments in the market.

The half-year figures will be published on 20 July.

On behalf of Sligro Food Group N.V.

Koen Slippens, CEO

Rob van der Sluijs, CFO

Click here for the full press release

Would you like to receive press releases of Sligro Food Group in your mailbox?

Please sent an e-mail with your name, address and e-mail to:

Charissa Kleij: ckleij@sligro.nl

Nomination of Mr Dirk Anbeek for appointment to the Supervisory Board of Sligro Food Group N.V.

Sligro Food Group’s Supervisory Board intends to nominate Mr Dirk J. Anbeek for appointment to the Supervisory Board during the Extraordinary General Meeting of Shareholders to be held on 29 June 2023.

This nomination is made in light of Mr Freek Rijna stepping down during the General Meeting of Shareholders on 27 March 2024, as per the rotation schedule. The Supervisory Board intends to have Mr Anbeek replace Mr Rijna as chair of the Supervisory Board on that date. Mr Anbeek will be a member of the Supervisory Board during the period up to 27 March 2024.

Publication of the 2023 annual report

Sligro Food Group N.V.’s 2023 annual report (in Dutch) was published on 8 February 2024.

The English version was published on 15 February 2024.

Click here for the annual report website

Revenue for Sligro Food Group N.V. for 2023 came in at €2,859 million

Revenue for Sligro Food Group N.V. for 2023 came in at €2,859 million, an increase of 15.2% compared to the €2,483 million in revenue in 2022. 8.8% of the increase was organic.

Read more in the press release below.

Sligro Food Group will publish its full annual results and annual report for 2023 prior to the opening of the stock exchange on 8 February 2024.

Would you like to receive press releases of Sligro Food Group in your mailbox?

Please mail your name, address and e-mail to Charissa Kleij: ckleij@sligro.nl

Result improvement in 2024

The operating result (EBIT) increased by €28 million to €43 million and profit rose from €6 million to €24 million. We succeeded in achieving a pleasing improvement in our result in a challenging market characterised by volume pressures and high cost inflation.

CEO Koen Slippens: 'At the start of the year, it was quickly apparent to us that market conditions would remain challenging, meaning that a strong focus on efficiency and cost reduction would be needed. Long-term high inflation led to restraint in consumer spending, which in turn put pressure on our customers’ volumes and, by extension, our volumes. Cost inflation was sharp, but through enhanced efficiency and focus, we were able to absorb the substantial increase in our procurement costs.

Due to pressure on their revenue model, our customers understandably looked even more closely at our performance as a supplier. So a great deal of attention was focused this year on meeting the required standard in our basic operations and making improvements wherever possible. We executed this very successfully in the Netherlands, and we will continue to give full attention in the coming period to supporting our customers in the challenges they experience. The processes to integrate and optimise the logistics of our overall infrastructure in Belgium that we started in the autumn of 2023 continued into 2024, finally reaching completion at around the mid-year mark. Our operational performance suffered in this phase, costing us customers and revenue. Today, though, our operations, management, control and infrastructure in Belgium are now at the level we have successfully applied in the Netherlands for many years. Based on the feedback we received from customers after the summer, we can be confident about 2025.

Through our vigilant focus on cost control in particular, we achieved a solid improvement in our operating result. The free cash flow was once again positive and the group’s financial position developed positively once again. Based on that result and our dividend policy, we propose a dividend for 2024 of €0.40 per share. Having already paid an interim dividend of €0.30 per share in 2024, a final dividend of €0.10 per share remains.

For us, 2025 is all about healthy revenue growth, against the trend, because we want to outperform general market growth in both countries. Operations are firmly in place in both countries and we see plenty of opportunities but, at the end of the day, the financial result is what counts. This is appropriately reflected in our theme for this year: Results count!'

Download the complete press release:

Press conference / Analyst meeting

Comments on the annual figures at a press conference and an analyst meeting on 27 March 2025.

11:00 AM: Press conference

01:30 PM: Analyst meeting

Location: Sligro, Van der Madeweg 39, 1114 AM Amsterdam

In our trading update of 17 April 2025, we will go into developments in the first quarter of 2025 in greater detail, and we will publish our interim figures on 17 July 2025.

Would you like to receive press releases of Sligro Food Group in your mailbox? Please sent an e-mail with your name, address and e-mail to Charissa Kleij: ckleij@sligro.nl

2023 annual figures

In what was a turbulent year, we managed to increase our market share in both the Netherlands and Belgium. Operating performance improved, as a result of which EBITDA rose by €11 million to €137 million. Net profit for the financial year was negatively impacted by non-recurring expenses and amounted to €6 million for 2023.

CEO Koen Slippens: 'After experiencing considerable pressure on operations and a globally disrupted supply chain in 2022, 2023 was all about restoring stability. Our basic service provision needed to become better and also more efficient, partly in view of the continuing steep inflation in costs. All things considered, we succeeded, with substantially improved and above all consistent average service levels and on-time delivery.

Our customers needed and continue to need good and reliable service more than ever and we see further opportunities for improvement in this area in 2024. After all, despite the on average great performance in 2023, individual customers experience suboptimal service from time to time, which may be a reason for switching suppliers. Our competitors also struggled with the same issues. We welcomed many new customers, but also saw some leave. On balance, the outcome was positive for us and we gained market share in both markets.

The market is in the grip of change and our customers are increasingly price-sensitive. This is no surprise, seeing as high inflation is confronting them with rising costs in virtually every aspect of their business model. Moreover,

many of our customers saw consumers increasingly pare back spending in the ‘out of home’ channel. As a result, we had to keep a tight rein on pricing policy and support our customers through services and product range choices so that they could continue offering acceptable menu prices despite the price inflation. We believe we amply succeeded but this issue is set to persist into the future and thus demands our continued attention.'

Read more in the press release:

Press release, 2023 annual figures

Press conference / Analyst meeting

Comments on the annual figures at a press conference and an analyst meeting on 8 February.

11:00 AM: Press conference

01:30 PM: Analyst meeting

Sligro Amsterdam, Van der Madeweg 39

Presentation, 2023 annual figures

In our trading update of 18 April 2024, we will go into developments in the first quarter of 2024 in greater detail, and we will publish our interim figures on 18 July 2024.

Would you like to receive press releases of Sligro Food Group in your mailbox? Please sent an e-mail with your name, address and e-mail to Charissa Kleij: ckleij@sligro.nl

The General Meeting of Shareholders on Wednesday 14 May 2025.

Shareholders of Sligro Food Group N.V. are invited to attend the annual General Meeting, to be held on Wednesday, May 14, 2025, at 10:30 AM at the company's office, Corridor 11 (5466 RB) Veghel.

Click here for more information.

Pagination

- Previous page

- Page 3

- Next page